What is the Keller Williams Commission Split?

Every agent is on a 70/30 commission split with Keller Williams Realty. That’s 70% to the agent and 30% to the local office/brokerage. KW is a franchise, and a franchise fee (6% on each transaction up to $3,000) is included in this calculation. The amount paid to the local office and the franchise fee is capped annually. Once the Cap has been reached, the agent receives 100% of all commissions until they reset on their anniversary date.

The Keller Williams Commission Split Explained

There are a couple of terms that you should understand when evaluating the KW Commission Split.

- Company Dollar

- Franchise Fee

- Cap

- Anniversary Date

Let’s explain each of these terms so that you fully understand the commission Split with Keller Williams.

Keller Williams Company Dollar

Company Dollar is the term used to describe the 30% of the commission paid to the local office/brokerage. Keller Williams calls their offices Market Centers. The 30% is what the local real estate brokerage company uses to fund their operations that provide local support for the agents. Because the local company uses it, we refer to it as company dollar. This amount gets tracked by the market center on each transaction and closing.

Franchise Fee

Keller Williams Realty International is funded by the calculation of the 6% of the commission payment. Because of this, the Keller Williams commission split is sometimes referred to as a 64/30/6% split. 64% to the agent, 30% to the market center, and 6% to KWRI (capped at $3000). This reference is not 100% accurate because the amount paid in the franchise fee always caps before the company dollar threshold is reached. Just understand that they are calculated against the total commission the agent/brokerage received in the transaction.

CAP

The best part about the Keller Williams commission structure is known as the “cap.” Each calculation of payment made to any portion of Keller Williams, whether the local office (Company Dollar) or KWRI (Franchise Fee), is stopped when a preset threshold is reached. There is a different cap amount for each calculation.

The Franchise Fee Cap is $3,000 for all agents in all parts of the United States.

The Company Dollar Cap varies based on the specific market center’s economic conditions and operating expenses. Some areas of the country are more expensive than others, and the Cap amount differs from one office to another to reflect this fact. Average and Median home prices are also considered when an office sets its Cap amount on company dollar.

An agent usually needs to sell 8-9 homes in the marketplace to reach the Cap. That being said, the calculation is made on the total commission dollars earned and not a set number of transactions. This prevents an agent that sells lower or higher-priced homes from being unfairly rewarded or penalized. Fairness is at the heart of the Keller Williams commission spit structure.

Once the agent has reached the required payment threshold, they have Capped and converted to a 100% to the agent and 0% to the office commission structure. The agent will receive 100% commission on the remaining calculation of the transaction they cap on, and 100% on every commission earned until their anniversary year begins again.

If the agent does not reach the threshold, the amount resets the following year. There is no penalty for not reaching a cap or carrying over as a debt to the agent for the next year. Life happens, and you may have unforeseen circumstances that prevent you from reaching your Cap. Keller Williams does not penalize you for this happening.

Anniversary Date

All of these calculations consider the date the agent joined Keller Williams Realty. They reset on the anniversary date and each year after that. Some refer to this as the anniversary month because the calculation is reset at the start of the month. Knowing this date allows agents and the office to plan their budget projections for the current and upcoming years.

An Example of the Keller Williams Commission Split in Action

An agent just joined Keller Williams and is ready to grow their real estate business. (This could be a brand new agent to the business or a 10 year veteran of the real estate market.) For the purposes of the example, the cap in their office is $18,000/yr total. This breaks down to $15,000 to the market center and $3,000 to KW International for the franchise fee.

How does the Keller Williams commission split compare to other companies?

As a point of comparison, let’s look at each of the areas listed above and show how other companies treat these points regarding commission splits and how the company views its agents.

First is Company Dollar. Companies decide to charge an amount to their agents. This charge can be a monthly desk fee or per transaction set fee that is never capped. The more the agent sells, the more they pay. These companies have decided to provide little to no support, and getting any level of training from the company is unheard of.

Other companies may have a sliding scale commission rate that starts lower for the agent and get more prominent as the production levels grow. Under this scenario, an agent may begin on a 50/50 or 60/40 split and be promoted to a 70/30 or 80/20 as the year progresses. Once the agent reaches the 80/20 or even 90/10 level, the calculation continues until the following year. Doing the math will show you how this system is less beneficial to the agent than the Keller Williams commission split. The agent pays more to the company at levels lower than 70/30. Then once they are at the 80/20 or 90/10 level, they will continue to pay on every transaction. Agents new to the business will overpay at the lower levels. This may cost them thousands of dollars for a top producer compared to a 100% based system.

How do real estate companies earn money? By charging agents a split of the commissions that the agent earns. What do the companies do with the money that they collect? Some spend a minimal amount of the higher splits on corporate brand advertising or satisfying wall street investors.

One company, in particular, brags about its 80/20 split. This company does have a so-called cap of the 20%, yet when you understand their system better, you see that they also start charging transaction fees from that point forward. The payments to the company never end for that year; they are just called something else. This same company claims that its cost of doing business is lower because they are a cloud-based company without physical offices. All of the support is provided by a central cloud-based structure, including broker support and training. Yet this company charges 20% for these services, capped at $16,000 before the transaction fees kick in, adding another potential $5000 on the following 20 transactions.

Keller Williams only charges 6% for similar services, including the Keller Cloud based KWCommand system.

So, what is the other company doing with the additional 14% plus 5k? Not paying for offices or local support and training. The type of question that an agent should ask is, “Are you reinvesting the money that you receive into helping me sell more homes, or are they pocketing the money?”

Another point that other companies only sometimes mention.

Some companies are focused on building the company brand, occasionally attracting buyers and sellers to contact the company. The company, in turn, refers these buyers and sellers out to their agents and charges the agents a referral fee for working with the client. This referral fee is in addition to the company’s commission split. These same companies will also advertise to prospective agents that the company provides leads. The question is, “at what price?”

The training, systems, and models at Keller Williams are designed to teach you how to find and run your own real estate business. Keller Williams does not position itself in front of the agents in the eyes of the consumer. Instead, it proudly stands behind its agents. A local agent, backed by a training and technology company that provides local, boot-on-the-ground support, will consistently outperform a national real estate brand or cloud-based company.

Real Estate Company Commission Structures Explained

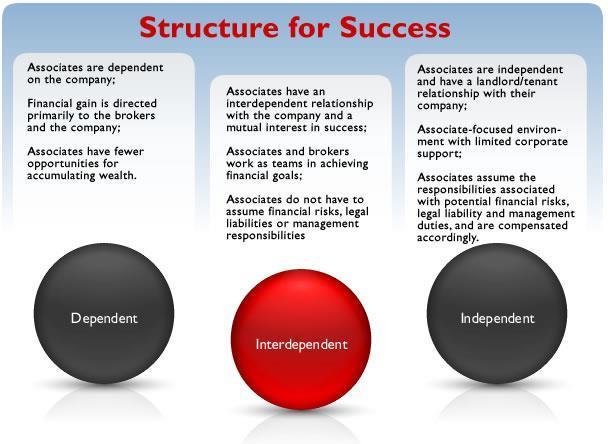

Real estate companies can be grouped into three categories based on their operations, commission structure, and how they view their relationship with the agents that are affiliated with the company.

These categories are:

- Independent Real Estate Companies

- Dependent Real Estate Companies

- InterDependent Real Estate Companies

The Independent Real Estate Business Model

You will find companies operating under an Independent business model on one side of the spectrum. These companies are sometimes misidentified as 100%, but they are mostly fee- or transaction-based.

Some of the characteristics of the independent real estate business model:

- Associates are independent and have a landlord/tenant relationship with their company;

- An associate-focused environment with limited high-level support;

- Associates assume all financial, legal, and management responsibilities.

These companies provide a place for the associate to hang their license and very little else. The broker is focused on collecting the desk or transaction fees from the agents and provides little to no training, technology, or support.

The motto of these companies: Good Luck…

The Dependent Real Estate Business Model

The Dependent real estate business model is on the other side of the spectrum. These companies are usually publicly owned or traditional real estate companies. Some regional real estate companies fall into this category. These companies are brand-centric and operate on a sliding commission split structure with added transaction, desk, or marketing fees.

Some of the characteristics of the dependent real estate business model:

- Associates are dependent on the company;

- Financial gain is directed primarily to the brokers and the company;

- Associates have fewer opportunities to accumulate wealth.

Commission splits favor the company over the agents with no caps on company dollars of franchise fees that the company collects. These companies focus on promoting the company’s brand over the agent’s brand, and their training and office structure reflect this. The publicly traded versions are very concerned with how Wall Street views them.

The motto of these companies: You have a chance at being successful because of our brand name and marketing. They view it this way. The agent is successful because the company is successful and not the other way around.

The InterDependent Real Estate Business Model

The InterDependent real estate business model is in the middle of the spectrum and is the model that Keller Williams Realty follows. The company views its associates as partners and as its customers. To understand how the interdependent real estate business model came to be created, we need to look at the history of Keller Williams. Summarized, it goes as follows. Gary Keller was a successful agent at a Dependent model company as a new agent. They told him he was only successful because of the company’s brand. Gary knew better because he knew how much work he had done creating his own business, despite some of the barriers set up by the company. He reached the point where he left the dependent model company and started his brokerage, partnering with Joe Williams to form Keller Williams Realty.

Shortly after opening, an independent model company came to town. At the time, some of the top agents in KW left for the new model company. (Many of those agents later returned to KW when they realized they were not getting the training and support at the independent model company. At that point, Gary and his first Associate Leadership Council laid out the framework of the interdependent model that takes the best of the other models and combines it into a company that is focused on being a training company that happens to be in the real estate business.

Some of the characteristics of the interdependent real estate business model:

- Associates have an interdependent relationship with the company and a mutual interest in success;

- Associates and brokers work as a team to achieve financial goals;

- Associates do not assume financial, legal, or management responsibilities.

The motto of this company: “Give a man a fish, feed him for a day. Teach a man to fish, feed him for a lifetime.”

Teaching the agent how to generate their leads and become owners of their real estate brands and businesses under the umbrella of Keller Williams.

Interdependent means that associates can be independent in running their own business yet share a portion of the commissions back with the company in exchange for world-class, award-winning training, technology, and local management and broker support.

Keller Williams provides the tools, resources, strategies, and empowerment for you to run and manage your career and your business to fund your life.

If you are like me, you are getting into real estate because you are looking for the freedom and flexibility that real estate can provide, but you want to ensure that you are not just left to fend for yourself.

You may also be like me in this regard. You are frustrated with being associated with a dependent-based company and paying commission fees with little to show for it at the end of the day.

That is why I joined Keller Williams nearly 20 years ago.

Ultimately, it wasn’t about the money or the Keller Williams commission split. It was about taking control of my career and schedule and ensuring that the company I worked with was indeed a partner in the business.

We like to call this approach agent-centric. Other companies claim to be all about the agents, but their commission structure and operational models differ.

Keller Williams only succeeds if you succeed. In business and life. The commission split and cap ensure you have the best opportunity to keep more money in your pocket. Keller Williams is a company where entrepreneurs thrive. Because of this, KW is #1 in the three main areas for a real estate business, Agent Count, Total Volume, and Total Sales.

Is The Keller Williams Commission Split Right For You?

People always ask me, “Why did you create this website?” My answer is simple. That is a decision that only you can make. That being said, I hope the information we provided about the KW commission split program will help you make an informed decision. If I can help people keep from making the same mistakes I made when I got into real estate, it will have been all worth it.

Are you looking to get your license and sell a home now and then? An independent company might be right for you.

Are you looking for a job with a real estate company with set hours and branding? A dependent company might be perfect if you don’t mind overpaying for what you get.

Are you looking to become an entrepreneur in real estate and run your own real estate business? Keller Williams is the place for you.

We are here to assist you with making your decision. Feel free to contact us today.